FAQs

How can we help you get started?

How can we help you get started?

Nicholas Nevada Claassens

June 10

There is a surge in the gig-worker economy and with it independent workers leverage marketplaces as a means to find customers. A report by OC&C partners predicts that the unstoppable growth of online marketplace spending will total approximately 50% of online spending.

The working benefits for gig-workers using marketplaces is security and consistency in a potentially turbulent job market, allowing them to benefit from more consistent customer interest as well as the flexibility of being able to choose what they work on. But how can we use embedded finance strategies to further benefit vendors?

A custom branded banking app or digital wallet is a great way to offer instant payouts to vendors and open up a range of embedded finance benefits to leverage within the marketplace.

Let’s dive into those benefits.

Allow your vendors to perform secure and instant payouts.

A survey from Visa direct has shown that 89% of surveyed gig workers are likely to sign up for real-time payouts. While, with Rehive, your vendors don’t receive instant funds into their bank accounts; they do have instant access to their funds they do have instant access to their funds in a mobile wallet account.

In addition to that, if they do choose to withdraw their funds they can do so at a fraction of the cost of conventional payout systems. You can reduce your payout fees by an approximate 13% with Rehive..

For vendors, of which over a third of the self-employed said that instances of late payment have increased and over a quarter have been paid late by a client during the pandemic, instant payouts prevent this.

Allowing for a trusted payment system that prevents late payments ensures that vendors have access to their funds; preventing a situation that one in six freelancers find themselves in; without sufficient funds to cover work-related or basic living expenses.

For example, let’s say you do payouts to drivers on a trucking marketplace. By doing instant payouts to drivers as they complete trips, they have access to money to pay their assistants and fill up the tank right away. No delays and frustration.

No fees on basic services.

Your own Cash-App-like solution for facilitating sending funds with no transaction fees. Cut down on operating costs within your marketplace and allow your vendors to easily send funds with no friction.

For the entrepreneuring individual this functionality lets them effortlessly keep track of who they have sent money to and allows them to request funds back.

PayPal and eBay is a classic example of a symbiotic relationship to close the loop between finance, commerce and incentives.

This iconic partnership between wallet/payment processor and marketplace have grown together and have proven the value add for providing a fast and easy way of sending and receiving funds within the context of a marketplace.

Cut your vendors’ costs with more affordable working expenses.

As a marketplace you can provide your vendors with value adding deals by partnering with businesses, enabling your vendors to have access to their working necessities while securing partners a valuable client foothold.

For vendors, having access to buying their operating supplies at a better rate increases their bottom line. Vendors are more likely to be able to get started in your marketplace if their operating costs are lowered.

For example Uber’s loyalty program for drivers lets them earn points with which they can obtain benefits like car maintenance discounts and gas savings. Partnered gas stations provide gas at a discounted rate and Uber drivers are incentivized to buy their necessities there. It’s a win-win for all parties.

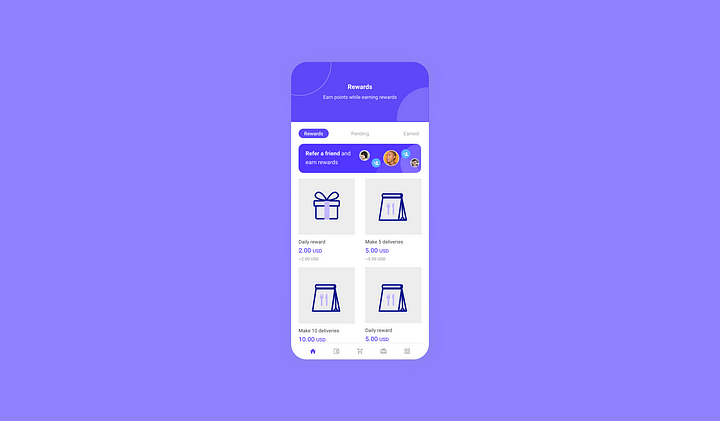

Build compelling and engaging reward campaigns to increase user engagement metrics.

Loyalty campaigns have a proven track record for not only improving user engagement and enjoyment but also improving total revenue. You can reward your vendors and their customers alike with configurable reward campaigns.

For example you could set up a loyalty program for consumers to incentivise repeat purchases at vendors in the marketplace. This benefits your vendors and their consumers alike. With approximately 50% of smartphone users regularly using loyalty applications, the ability to provide your vendors with the infrastructure to support loyalty campaigns is a key value-add for any marketplace.

That’s before considering how referral campaigns can improve customer acquisition by up to 10%.

These reward campaigns can add organic growth to your marketplaces through rewards and gamified incentives, drawing in new vendors and keeping existing vendors engaged and satisfied with their experience.

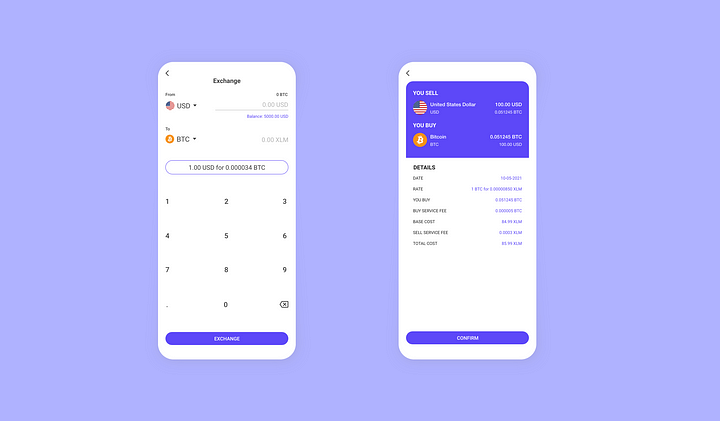

Make crypto and currency conversions easy.

Implement your own Cash-App-like embedded finance strategies to provide your vendors a way to convert their currencies. Easily convert between different currencies, fiat or crypto, to allow your vendors to enter the crypto market.

This can provide an additional revenue stream for marketplaces for facilitating the conversion while simultaneously making cryptocurrency purchases and currency conversions easier than ever. In 2021, over 70% of Cash App’s revenue cam from buying and selling bitcoin in the app.

Cryptocurrency can attract gig-workers to your marketplace for these reasons:

This not only benefits your gig-workers but also allows you to hire talented individuals from across the globe.

Rehive is designed to be flexible and extendable. Our goal is to continue doing integrations with more financial infrastructure providers to add support for cards, savings, loans and more. Choosing Rehive lays a strong foundation for your embedded finance strategy where you don’t have to build anything yourself or force embeddable integrations in your existing app. The end result is a meticulously designed neobanking-style experience, all wrapped with your branding.

If the above benefits sound valuable for your marketplace, don’t hesitate to set up a test app with Rehive absolutely absolutely free.

There are a variety of help center guides you can find for getting started and anything you get stuck on you can reach out to us on our support page here.

If you are based in America, we have recently launched our integration with Wyre. You can use Wyre and Plaid to solve your compliance, on/off ramps, custody and brokerage to bootstrap your setup in a matter of days!